trust capital gains tax rate australia

The income tax rates on income earned from assets in a testamentary trust are the same as personal income tax rates. What is the capital gains tax rate on a trust.

If the shareholder is the.

. Companies with a turnover less than 5000000000. She will pay tax on this gain at her individual income tax rate. To calculate a capital gain or loss you have to determine if a CGT event has happened.

Capital gains tax rates on most assets held for a year or less correspond to ordinary income tax brackets. A flat rate of 30 for corporate beneficiaries. The marginal tax rates for individuals.

She owns the shares for 6 months and sells them for 5500. A child can apply for a tax file number TFN there is no minimum age. This guide is not available in print or as a downloadable PDF.

Contact North Andover Trust Attorneys. If an asset is held for at least 1 year then any gain is first discounted by 50 for individual taxpayers or by 333 for superannuation funds. Net capital losses in a tax year cannot be offset against normal income but may be carried forward indefinitely.

Capital Gain Tax Rate. Table of Current Income Tax Rates for Estates and Trusts 202 1. Capital Gains Tax Advantages.

The tax implications of trust accounts. Capital losses can be offset against capital gains. The income of the trust estate is therefore 300 100 interest income 200 capital gain and the net income of the trust is 200 100 interest income.

However once the general 50 discount is deducted the taxpayer only declares 5000 capital gains income the tax on which at 37 is 1850. Maree declares a capital gain of 500 in her tax return. Trustees pay 10 Capital Gains Tax on qualifying gains if they sell assets used in a beneficiarys business which has now ended.

Given the gains are then distributed to the New Zealand resident beneficiaries Australian tax is deemed payable by the trustee on their behalf. A trustee is able to minimise the overall tax paid on the trusts income by streaming income to beneficiaries with low marginal tax rates. Some assets are exempt from CGT such as your home.

Trust tax rates are very high as you can see here. Accordingly when the beneficiary prepares their tax return they must include any trust distributions as part of their income. It is a common misconception that there is a flat rate of tax for a capital gain however there is in fact no set tax rate on capital gain earnings.

0 2650. Companies with a turnover greater than 5000000000. Suppose a person earned 35000 a year and made a taxable capital gain of 30000 after the discount.

10000 of that again would be taxed at 19 per cent which would take them to the next tax. The effective tax rate on the capital gain of 10000 is 185. There is a formal trust quote the trusts TFN.

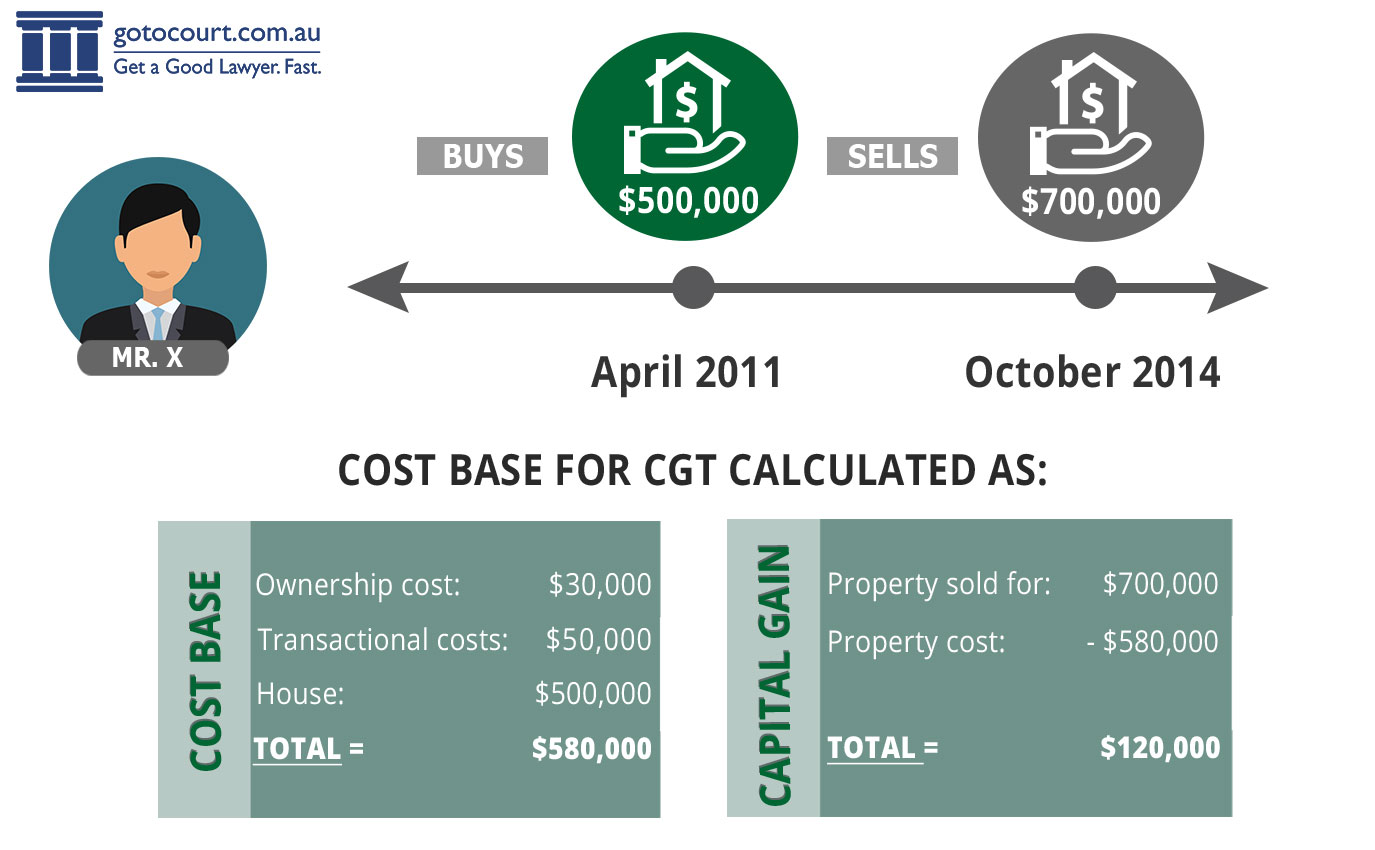

The Guide to capital gains tax 2021 explains how capital gains tax CGT works and will help you calculate your net capital gain or net capital loss for 202021 so you can meet your CGT obligations. Income tax is levied on the trusts taxable income which is calculated by taking into account both assessable income and exempt income. The tax on the capital gain would be 37.

The tax is calculated on the individuals marginal tax rates and will depend on what tax bracket the taxpayer currently falls into. The taxation rate on these distributions is. There is a capital gains tax CGT discount of 50 for Australian individuals who own an asset for 12 months or more.

If you dont quote a TFN pay as you go PAYG tax will be withheld at 47 from the unfranked amount of your dividend income. One of the tax advantages of a family trust is related to Capital Gains Tax CGT. A capital gain of 200 that is eligible for the CGT 50 discount.

There are links to worksheets in this guide to help you do this. The problem in turn is that few customers want these trust automatic distributions to be made to their children or. For more information please join us for an upcoming FREE seminar.

Guide to capital gains tax 2021 About this guide. Trust accounts in Australia are subject to several tax implications and these can include income tax capital gains tax and stamp duty. If you have additional questions about how capital gains taxes impact an irrevocable trust contact the North Andover trust attorneys at DeBruyckere Law Offices by calling 603 894-4141 or 978 969-0331 to schedule an appointment.

However the ATO allows income earned from assets in a testamentary trust to. 10 12 22 24 32 35 or 37. Given that the top marginal tax rate of 396 and the 38 net investment income tax apply to estates and trusts with taxable income in excess of only 12150 in 2014 not to mention state income taxes the tax impact of retaining capital gains in a trust can be severe.

Including a 10000 capital gain in income would cost 3700. A trustee derived the following amounts in the 201415 income year. Children are not exempt from quoting a TFN.

Australia Corporation Capital Gains Tax Tables in 2022. An irrevocable trust needs to get a tax ID EIN number and pay taxes each year by filing a 1041 tax return. As part of the trusts net income or net loss the trust has to take into account any capital gain or loss.

The trust deed defines income to include capital gains. She has no other capital gains or losses. With the current tax free threshold of 18200 beneficiaries are potentially able to receive up to 18200 of tax free income from the testamentary trust each year.

Namely the 50 CGT discount. What Is The Tax Rate For Trusts. The result of this is that the New Zealand resident beneficiaries are subject to Australian tax at non-resident tax rates between 325 and 45 on capital gains derived from New Zealand property.

For capital gains over 6500 trusts and estates must pay a rate of 15 percent as opposed to a 20 percent rate on gains from those above 13000In order for capital gains realized on a trust to be credited toward a higher basis or administration to be avoided date of death values need to be obtained. Income can be taxed either as Trustee Income at a 33 tax rate or as a Beneficiary Income at the marginal tax rate of a Beneficiary unless a distribution is made to a NZ resident minor beneficiary in which case the applicable tax rate will be 33. This means you pay tax on only half the net capital gain on that asset.

In certain circumstances it may also be possible to distribute the trusts capital gains to beneficiaries to avoid the higher rates of capital gains that usually apply to trusts as well as the net capital gains tax of 38.

Capital Gains Tax On Shares In Australia Explained Sharesight

End Of Financial Year Guide 2021 Lexology

Bracket Creep And Its Fiscal Impact Parliament Of Australia

A Brief History Of Australia S Tax System Treasury Gov Au

Taxation In Australia Wikipedia

Tax Gap Program Summary Findings Australian Taxation Office

Calculating Capital Gains Tax Cgt In Australia

A Brief History Of Australia S Tax System Treasury Gov Au

Taxation In Australia Wikipedia

Calculating Capital Gains Tax Cgt In Australia

Individuals Statistics Australian Taxation Office

Trust Tax Rates 2022 Atotaxrates Info

Taxation In Australia Wikipedia

Australian Income Tax Brackets And Rates For 2021 And 2022

A Brief History Of Australia S Tax System Treasury Gov Au

Taxation In Australia Wikipedia

In Gold We Trust Why Bullion Is Still A Safe Haven In Times Of Crisis Gold Bullion Gold Money Buying Gold

Taxation In Australia Wikipedia